The Priciest Shareholder Fight Ever Is Headed to Disney’s Boardroom

More than $70 million could be spent in bid to win everyday

investors’ votes

By

Lauren Thomas

Feb. 11, 2024 5:30 am ET

A boardroom

brawl at

Walt Disney DIS is

expected to be the most expensive shareholder fight ever, and a chance

for everyday investors to have a big impact.

Two activist hedge funds—Nelson Peltz’s Trian Fund Management and the

smaller Blackwells Capital—are separately going toe-to-toe with Disney

to gain spots on its board and challenge the strategy of Chief

Executive Bob Iger.

All in, the three parties could spend north of $70 million ahead of an

April 3 shareholder vote. They are already shelling out for slick

marketing materials, social-media blitzes and the services of proxy

solicitors—akin to campaign strategists—who wrangle shareholder

support for their clients’ board candidates.

|

Trian

Fund Management CEO Nelson Peltz is competing for a seat

on Disney’s board. PHOTO: CALLA KESSLER/BLOOMBERG NEWS Trian

Fund Management CEO Nelson Peltz is competing for a seat

on Disney’s board. PHOTO: CALLA KESSLER/BLOOMBERG NEWS

|

One reason for the high price: the millions of individual investors

who own an outsize portion of Disney’s roughly 1.8 billion shares.

They control over a third of Disney’s stock—more than is typical for a

public company. Institutional investors such as

BlackRock

and Vanguard hold the rest, and their votes carry heft, too. Getting

the word out to such a widespread shareholder base is costly.

The costs could be much lower if the activists don’t take their fights

to a vote, either by settling with Disney or backing away. Trian

called off its first

proxy attempt at Disney last year.

Competing visions

At the crux of the proxy fight is a disagreement over Disney’s

strategy and how to best nudge the company’s stock price, which has

been almost cut in half from its 2021 high. The company now has a

market value of around $200 billion.

Trian and a former

Marvel executive it is working with have a combined stake

valued at around $3.5 billion. The hedge fund has been urging

shareholders to “restore the magic” at Disney, with a matching

internet domain name making its case. It says the company needs to

find a clear successor to Iger, make its streaming

margins “Netflix-like” and pull its studios out of a rut.

It is running two candidates, including the 81-year-old Peltz, who

holds board seats at other companies, including

Unilever.

Blackwells,

which has a tiny stake valued at around $15 million, has suggested its

three nominees could help explore a breakup of the company.

Disney has sought to appease shareholders with a series of

announcements including an investment in “Fortnite”

maker Epic Games; plans to stream Taylor Swift’s Eras

Tour concert movie on Disney+, and a partnership with Fox

and

Warner Bros. Discovery

to launch a sports-focused

streaming service.

Disney

enlisted the help of cartoon character Professor Ludwig Von Drake,

Donald Duck’s paternal uncle, in an animated video with a step-by-step

voting guide.

Peltz could top his own record

All in, the cost is expected to top that of Trian’s

2017 clash with

Procter & Gamble,

currently the priciest

proxy fight on record, with a price tag of $60 million.

(Peltz was ultimately given a seat

on the board of the Crest toothpaste owner after the vote

ended in a near-tie.)

|

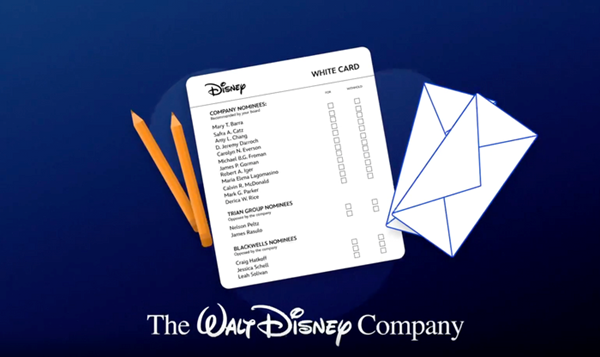

Disney

released a video with a step-by-step voting guide for

shareholders. PHOTO: DISNEY Disney

released a video with a step-by-step voting guide for

shareholders. PHOTO: DISNEY

|

Disney expects its total expenses to be about $40 million, while Trian

estimated it could spend at least $25 million, regulatory filings this

month show. Blackwells expects to spend around $6 million.

Trian appears determined to press ahead with its current quest. After

Disney’s shares surged more than 12% Thursday following a

better-than-expected earnings report and the unveiling of new

initiatives, Trian doubled down. “It’s déjŕ vu all over again,” it

said. “We saw this movie last year and we didn’t like the ending.”

Another twist

In addition to being one of the highest-profile proxy fights in years,

the fight is captivating Wall Street advisers because it will be one

of the first votes to put the newly

implemented universal proxy card to the test.

Shareholders historically either had to vote for a company’s entire

slate of directors or an activist’s. Universal cards list both sets of

candidates in the same place, allowing shareholders to mix and match.

They make it more likely an activist could claim a partial victory by

winning at least one board seat. Working in Disney’s favor is the fact

that the small number of individual investors who bother to vote in

proxy fights tend to support companies.

Most individual investors just aren’t paying attention, according to

John Ferguson, a senior partner at Saratoga Proxy Consulting, which

isn’t involved in the Disney fight. “To do it right,” Ferguson said,

“this will definitely be the most expensive fight we’ve seen.”

Write to Lauren Thomas at lauren.thomas@wsj.com

Appeared in the February 12, 2024, print edition as 'Priciest

Shareholder Fight Ever Is Headed to Disney’s Boardroom'.