INTELLIGENT §

TRANSPARENT

§

GLOBAL

|

AUGUST 19,

2023

SEMAFOR

Business |

Liz Hoffman

Liz Hoffman

â

Semafor/Emma Roshan |

Alan Shaw had been CEO of Norfolk Southern for just nine months when

his phone rang. One of his trains had derailed in East Palestine,

Ohio, and was dumping toxic chemicals into the community of 5,000.

Six weeks earlier, he’d unveiled to investors his plan for the giant

railroad, promising to spend billions hiring workers and upgrading

equipment to avoid the service outages that had plagued the industry

every few years like clockwork.

Shaw, 55, has spent half of his tenure as CEO trying to repair the

damage to East Palestine — dredging wastewater and cutting checks to

local businesses — and to his company’s reputation and business.

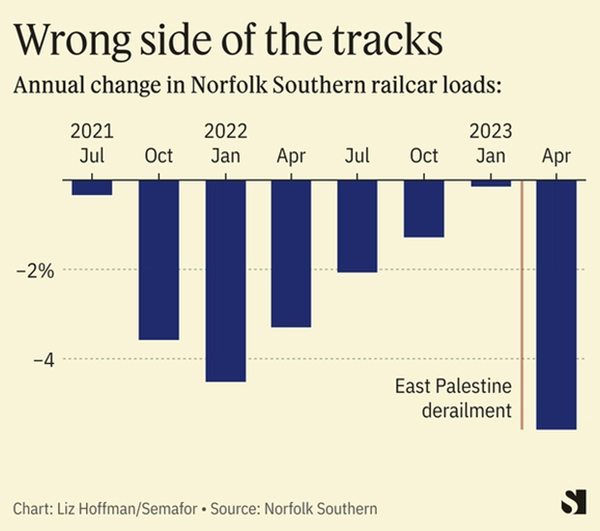

Cleanup costs have doubled from early estimates to $800 million, the

stock trades at a discount to its rivals, and Norfolk Southern’s

trains are still emptier than they were a year ago.

Over lunch of Greek salads and dorado in midtown Manhattan, we talked

about the recovery, taking on trucking, the manufacturing

“supercycle,” and his scorecard for the Biden administration. This

interview was condensed and edited for clarity.

Liz: What’s

the response when you introduce yourself to locals?

Alan: Really

tough in the beginning. I did these listening sessions, eight to 10

people at a time from people who wanted answers we didn’t have.

We have 13 employees who live in East Palestine. And in the immediate

aftermath, I wrote them an email, and I said we’re going to make it

right. One of them wrote me back and invited me to his home. So I went

there on a Saturday in mid-February and sat down with him and his wife

and a bunch of their neighbors. And we were walking to the car

afterwards, and I said ‘I want you to report to me.’ I’m going to give

you [a budget of] $1 million. That’s Jeremy Vranesevich, who’s been

our community liaison on the ground.

Is this what your tenure is going to be about?

I hope not. We’ve got 300 people working to make things right in East

Palestine and I want them focused on that. But I want the other 19,700

employees focused on the business.

Last December, we laid out a new vision for Norfolk Southern. In the

past, we had this intense focus on near-term results. The easiest way

to get there is to cut and to throw costs over the fence at your

client. That makes for bad service, and it’s counterproductive because

when demand would come back, we wouldn’t have enough resources. This

is a long-term focus.

We’ve gotten into this cycle in the rail industry where every three to

four years, there’s a service crisis. No company is going to grow over

the long term if it provides its customers lousy service.

Airlines do seem to be testing that theory.

I’m not gonna take a shot there. But that’s why we’ve got a longer

term vision to invest in our company, even through economic downturns.

Every CEO says that, though. And then the market turns and you start

hearing from shareholders or you get

a hostile bid or something else happens.

Our conductor training pipeline is among the highest ever. Our capital

budget this year is $100 million over last year. My money is where my

mouth is.

And it’s being proven out. At the beginning of this year, our service

levels were at multi-year highs. Customers were noticing and pushing

more business to us. And then the derailment happened.

Rail volumes are one of those proxies, like cardboard

boxes, for the economy. What’s your read right now?

Warren Buffett has said in the past that if he could have one economic

indicator to make his investment decisions, he would look at weekly

railcar loads.

He owns one!

We do have a unique view. We have 5,000 customers, we handle 7 million

shipments a year. There are some headwinds in the economy,

particularly in the consumer-oriented markets. But when I talk to the

CEOs of our consumer-facing customers, they say they’re continuing to

invest through the downturn, because it’s only a question of when the

U.S. consumer comes back, not if.

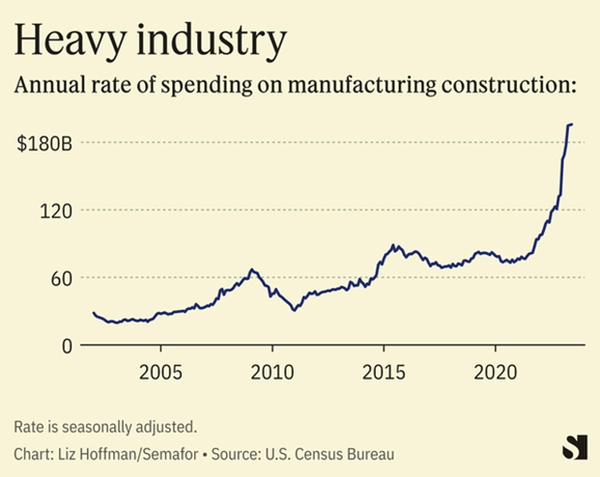

You see all these investments that are being supported by onshoring

and federal programs like CHIPS. And overseas companies are looking at

the U.S. and saying, ’OK, cheap and reliable energy, talented and

diverse labor force, pro-business environment, lots of consumers to

sell to, a good logistics infrastructure.’ That’s how you get this

non-residential supercycle that we’re in and that’s going to spur

growth.

Speaking of growth, where do you guys grow from here?

Trucks. The trucking market in the United States is about $860

billion. Together, all the big railroads, revenue is about $90

billion. So I’m not really interested in going out there and picking

off share from other rail companies. I’m looking at that much bigger

pie.

We’re never going to compete on fresh flowers or time-sensitive

medical shipments. But rail is cheaper than trucking. It’s more

labor-efficient and more fuel-efficient. About 30% of our customers

have set carbon reduction goals, and we’re four times more

carbon-efficient than trucks.

The problem has been service. Consider our paper business. Most U.S.

paper production is in

the southeast, and every single one of those companies built their

plants around a railroad. Now half of their volume is going by truck

because of unreliable rail service. I want that volume back. Every

time we have a service disruption, it costs us between $600 million

and $800 million a year in revenue.

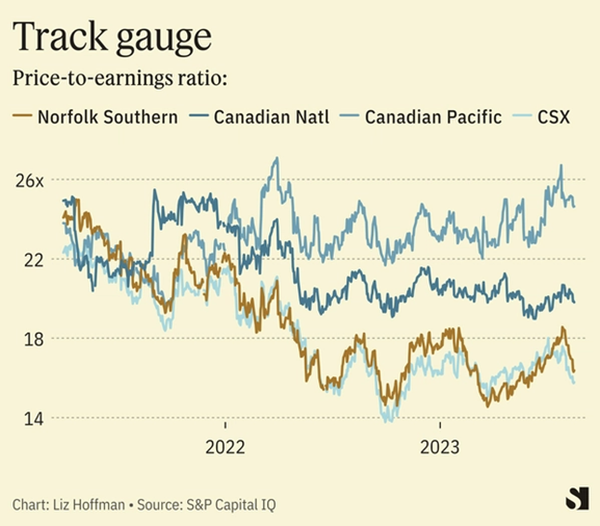

Your stock trades at a discount to peers. Is that from the derailment?

It’s uncertainty about the costs for East Palestine and how quickly we

can get back to those January levels. We’ve made a lot of progress

over the last few months in our weekly service figures. Turning your

equipment faster means more capacity, service is better, and you’re

going to attract more demand for your product.

How’d you get the job?

I was an engineer and then I worked in finance and I figured, OK, I’m

left-brained so I’ll just keep doing this. Bill Fox, the senior vice

president, saw something in me — I still don’t know what — and said,

‘You need to go into marketing.’

That feels like an insult, but I can’t quite decide why.

I don’t know anything about selling. He said ‘you’ll figure it out’

and I guess I did. I built a coal transportation group. Then I moved

to chemicals and then to intermodal operations, working at the

terminals.

How’s Pete Buttigieg doing?

He was very engaged during the labor negotiations, and he’s been very

involved in East Palestine. I say to him, look, we’re your best bet

when it comes to this administration’s priorities. We take trucks off

the highway. We have high-paying union jobs. We fund our own

infrastructure — we spend $2.2 billion in capital expenditures on $12

billion of revenue.

You just went through a major negotiation with your union, mostly over

sick days, in a very tight labor market. That seems like a pretty

reasonable ask.

And now they have it. And we’re the only

railroad that does. [CSX reached a deal this spring to offer sick

days to about two-thirds of its employees. Norfolk Southern’s

arrangement covers all unionized workers.]

We’ve added 1,400 people in the last year, and most of them are union

employees. When I hired a safety consultant, I engaged with the heads

of all 12 of our unions. I wanted their involvement, because that’s

the only way this is going to work. So if you look out on our website,

you’ll see an open letter from

me and the heads of each union, talking about safety. Twelve union

logos on top — you’re not going to find that anywhere else.

© 2023 SEMAFOR INC. |