A Look at This Year’s Voting Trends

Following the US N-PX Disclosures

Posted by Matthew Scott, Proxy Insight, on

Sunday, January 17, 2021

|

Editor’s Note:

Matthew Scott is Vice President of Proxy Insight. This post is

based on a Proxy Insight memorandum. |

Familiar Territory

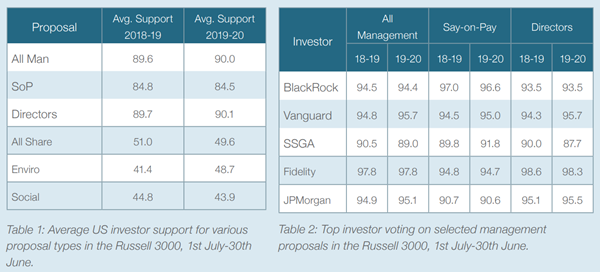

Across management proposals, there was not much change this year

compared to last. There was a 0.4 percentage point move upwards in the average

investor’s support for both all proposals and director elections, and a drop of

0.3 points for Say-on-Pay. These are not exactly headline-grabbing changes,

perhaps not even meaningful ones.

It is, however, a little interesting to note that pay votes

ticked in the opposite direction to the other two. The widening gap between

Say-on-Pay support and the average management proposal shows just how

contentious executive pay continues to be, particularly in a year when many

companies faced criticism for lavish payouts while under pressure as a result of

the pandemic. A look at shareholder proposals shows some more dramatic changes.

Last year, a typical US asset manager supported more shareholder proposals than

they opposed. This year, that support fell by 1.4 percentage points, taking the

figure below that 50% mark.

The average investor’s support for environmental shareholder

proposals, on the other hand, rose by a rather dramatic 7.3 percentage points.

This would be a trend to make a climate laggard sit up and take notice in any

year. The fact that this shift happened even as support for shareholder

proposals in general fell makes it even more noteworthy.

There has been similarly little change as a whole among the top

investors, shown in Table 2. Across key resolution types, their voting has

remained broadly consistent with just a 1-2 percentage point shift here and

there. This is the second year we have seen relatively little change across both

broad trends and the largest investors, suggesting that investors generally have

really settled into an approach they are happy with. Whether they would all

agree individually as to quite what that optimal approach is, on the other hand,

another question.

Saying ‘Nay’ to Pay

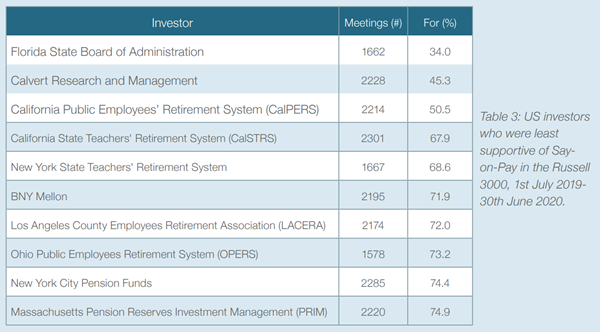

Indeed, some investors have settled on an approach that is very

different from others. Perhaps unsurprisingly, this is made quite clear when we

look at the highly contentious and truly evergreen issue of executive pay.

As with our analysis last year, it is not generally our N-PX

filers who fill most of the spaces on our list of US investors most likely to

oppose Say-on-Pay resolutions. This list is, once again, dominated by pension

funds, though a few major fund houses do make the top 10, as shown in Table 3.

This ranking includes only investors with at least $10 billion in

assets under management, who have disclosed votes for at least 1,000 Russell

3000 meetings. It is worth mentioning that last year’s list was topped by the

Minnesota State Board of Investment, and only a lack of disclosed meetings

prevented it from doing so again. Otherwise, the list is broadly similar to last

year’s.

N-PX filers, especially large ones, are better represented at the

opposite end of the scale. Several of the big names, including the three largest

investors in the world, are in the top 10 most likely to support an advisory pay

vote. This is perhaps not surprising. These mega-investors make no secret of the

fact they prefer to use their considerable influence to pressure companies

directly, making voting a last resort when they believe a company is simply

unresponsive to their efforts to engage.

Conclusion

This is another year that saw no great changes among the very

biggest investors or the field as a whole. However, it should be remembered that

this short analysis represents only the overview of this year’s trends. No doubt

there is much more to find, including voting shifts from investors not so very

much smaller than the top few included in this article. We encourage our clients

to look closer at the data most relevant to them, and if you are not yet a

client you can still access the data with a free trial of our platform.

|

Harvard Law School Forum

on Corporate Governance

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2021 The President and

Fellows of Harvard College. |