|

Buffett Beats Activists at

Berkshire, Rather Than Joining Them

by

David Wilson

October 14, 2015 — 8:00 AM EDT

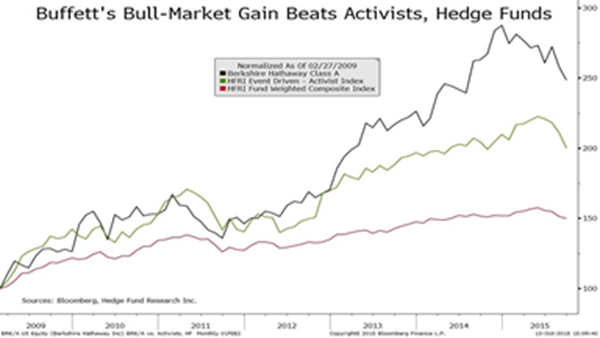

► Company's

shares outpace activist-fund index in bull market

► Activists are

`like sharks: they've got to keep swimming'

Warren Buffett has stock performance on his side in

criticizing activist investors and the strategies designed to help

companies avoid them, as he did yesterday.

The chart below compares the shares of Buffett’s

Berkshire Hathaway Inc. with an index of activist hedge funds since

March 2009, when stocks entered a bull market. Hedge Fund Research

Inc. compiles the activist indicator and a broader hedge-fund gauge,

also used in the chart, on a monthly basis.

|

■

Warren Buffett, chairman

and chief executive officer of Berkshire Hathaway.

Photographer: Scott Eells/Bloomberg |

Berkshire’s Class A shares surpassed the activist index

in 2013, and maintained their bull-market lead this year even as they

dropped. The Omaha, Nebraska-based company ended last month with an

increase of 148 percent, beating a 100 percent advance for the

activists and a 50 percent gain for the Hedge Fund Research composite

index.

Activists are “like sharks: they’ve got to keep

swimming,” Buffett said yesterday at Fortune’s Most Powerful Women

Summit in Washington. “They stretch for targets and you’re seeing

that.” Companies looking to keep them away are better off focusing on

performance and shareholder communication than putting up defenses

promoted by securities firms, he said.

Buffett said he prefers to invest in companies where

he’s able to “join in the spirit of the whole organization,” though he

added that activists have a place where businesses aren’t being

managed in the interests of shareholders.

One of the biggest activist investors, billionaire Carl

Icahn, delivered bull-market gains comparable to those of Berkshire.

Shares of his publicly traded investment partnership, Icahn

Enterprises LP, rose 149 percent from March 2009 through last month.

Icahn and another activist, Bill Ackman, have criticized Buffett’s

view of their strategy.

©

Bloomberg L.P. |