Posted by Yaron Nili,

Co-editor, HLS Forum on Corporate Governance and Financial Regulation,

on Monday August 18, 2014 at

8:52 am

|

Editor’s Note: The following post comes to us

from Bridget Neill, Director of Regulatory Policy at Ernst &

Young, and is based on an Ernst & Young publication by Ruby Sharma

and Allie M. Rutherford. The complete publication is available

here. |

Nearly 40 investor

representatives shared with us their key priorities for the 2014 proxy

season. We review the developments around these topics over the 2014

proxy season through shareholder proposal submissions, investor voting

trends, proxy statement disclosures and behind-the-scenes

company-investor engagement.

Key Developments in the 2014 Proxy Season

Activist investors are becoming more active and influential:

Nearly 150 campaigns by hedge fund activists were launched in just the

first half of this year. Both companies and long-term institutional

investors are learning to navigate this changing landscape.

Activists are now:

»

Targeting larger companies—no company or market is immune

»

Advancing efforts through dialogue and collaboration with long-term

institutional investors, including identifying companies with governance

concerns as potential targets

»

Developing more sophisticated sector- and company-specific analysis

»

Using 14a-8 shareholder proposals and other proxy mechanisms to call

attention to their concerns

»

Winning more board seats, in large part through reaching settlements

with the companies rather than going to a shareholder vote

Attention is turning to board composition and renewal

strategies: Both investors and boards are placing greater

attention on whether the right directors are in the boardroom. They are

also focused on whether boards are regularly refreshing and providing an

exit for directors whose expertise is no longer relevant.

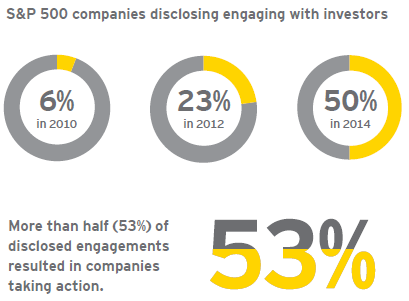

Company-investor dynamics are evolving as engagement becomes

mainstream: Company-investor engagement on governance topics

continues to grow. While executive compensation remains the primary

engagement driver, a variety of other governance topics—board and

executive leadership, board composition and diversity, and sustainability

practices and reporting, to name a few—are increasingly part of those

conversations.

Ongoing Proxy Season Trends

»

Shareholder proposal submissions remain high, with a focus

on environmental and social topics: In recent years, the

number of shareholder proposal submissions has been at an all-time high,

with proposals on environmental and social topics accounting for the

largest category of proposals submitted at 45% of the total.

»

SOP support holds steady: More than 2,200

companies so far this year have gauged investor support for their

compensation policies and practices through a say-on-pay (SOP) vote.

This marked the second SOP vote for companies that elected triennial SOP

frequencies. While most companies respond quickly to low SOP votes, a

handful of companies remain unresponsive to shareholder opposition to

their pay practices. Over the past four years, 23 companies have not

secured majority support for their SOP votes for two or more years.

»

Annual director elections by majority vote and independent

board leaders increase: Many investors favor the annual

election of all directors under a majority vote standard and want to see

boards with a strong independent chair or lead director. Companies that

do not have these practices may be the focus of shareholder engagement

or recipients of shareholder proposals.

Some large asset managers are encouraging companies to adopt annual

director elections and majority voting through letters to boards and

engagement conversations. Most investors are unified in their beliefs—and

will support proposals that implement annual elections and majority

voting.

13

Year 2000 data based on Investor Responsibility Research Center, Board

Practices/Board Pay 2002.

Toward More Meaningful Communications—and Disclosure

As

investors turn their focus to the boardroom and continue to use

shareholder proposals to effect governance changes, it is important that

company communication efforts—through direct dialogue with investors and

proxy statement disclosures—become more effective. The way forward is

likely more focused and purpose-driven company-investor engagements and

more meaningful proxy disclosures.

The

complete publication is available

here.

|

All

copyright and trademarks in content on this site are owned by their

respective owners. Other content © 2014 The President and Fellows of

Harvard College. |

|