New York Times, November 26, 2006 article

November 26, 2006

|

Gilded PaychecksGroup Think |

LIKE Lake Wobegon, Garrison Keillor’s fictitious Minnesota town where all the children are above average, executive compensation practices often assume that corporate managers are equally superlative. When shareholders question lush pay, they are invariably met with a laundry list of reasons that businesses use to justify such packages. Among that data, no item is more crucial than the “peer group,” a collection of companies that corporations measure themselves against when calculating compensation.

But according to a handful of pay experts who are privy to the design of pay practices at the nation’s largest corporations, many of these peer groups are populated with companies that are anything but comparable. They also say corporate managers themselves — who have an interest in higher pay — are selecting which companies make it into a peer group. And because these companies are often inappropriate for comparison purposes, their use has helped inflate executive pay in recent years.

|

Marko Georgiev for The New York Times James F. Reda, a New York compensation consultant, says inappropriate peer groups are one reason that executive pay has soared. |

“The peer group is the bedrock of the compensation philosophy at a company,” said James F. Reda, an independent compensation consultant in New York. “But a lot of people do it by the seat of their pants, and that is part of the reason why executive pay has really skyrocketed.”

The use of peer groups to calculate executive pay has become ubiquitous in recent years. This is partly in response to the Securities and Exchange Commission’s requirement that companies compare their stock performance with a peer group in tables in the section of their proxy filings devoted to shareholder returns. Theoretically, these tables allow investors to compare their company’s performance against objective benchmarks.

But as is true with much about executive pay, details about exactly how peer groups are compiled have been kept under wraps. The worry among investors, of course, is that executives, consultants and directors simply cherry-pick peer-group members, thereby pumping up pay packages.

Current disclosure rules require neither the identification of companies in a compensation-related peer group nor the rationale behind their selection. Usually, the most a shareholder learns about companies in a compensation peer group is that they are in the same industry or of a similar size.

This ambiguity will change when new Securities and Exchange Commission disclosure rules go into effect on Dec. 15. The rules will require a corporation to reveal which companies it uses in its peer group and to provide an extensive description of its compensation philosophy.

Under the new rules, company officials will also have to certify the accuracy of their pay disclosures. As a result, peer groups are likely to attract increased scrutiny, said Mark Van Clieaf, managing director of MVC Associates International, a consulting firm that specializes in organization design and pay-for-performance standards.

“Is benchmarking pay across companies truly comparing apples to apples?” Mr. Van Clieaf asked. “Failure to have a legally defensible process” can lead to “materially false” disclosures, he said.

POSSIBLE problems with the use of peer groups burst onto the scene in 2003, when the New York Stock Exchange disclosed that it had paid its chairman, Richard A. Grasso, about $140 million in total compensation. Amid a firestorm over the pay, Mr. Grasso resigned.

One reason for the outcry was the makeup of the peer group that the exchange’s compensation committee used to determine Mr. Grasso’s pay. The group included highly profitable investment banks and financial institutions that were far larger and more complex than the Big Board, which, at that time, was a nonprofit organization.

Brian J. Hall, a Harvard Business School professor and an expert on management incentive systems, conducted an analysis of Mr. Grasso’s compensation and provided it to the judge overseeing the case that the New York attorney general’s office filed against Mr. Grasso.

Mr. Hall, hired by the attorney general as an expert witness, found that the companies the New York Stock Exchange board used in its peer group had median revenue of $26 billion, more than 25 times that of the exchange. Median assets of companies in the group were 125 times the Big Board’s assets, and the median number of employees in the peer-group companies was 50,000, or roughly 30 times that of the exchange.

The peer group was flawed, Mr. Hall contended, resulting in unreasonably high compensation for Mr. Grasso. Experts hired by Mr. Grasso concluded that his pay was, in fact, reasonable. But the judge presiding over the case ruled last month that Mr. Grasso must return as much as $100 million to the exchange. Mr. Grasso has continued to defend his pay as appropriate; earlier this month, he asked a state appeals court to block the judge from requiring him to return the money. A hearing on the matter is set for Wednesday .

Some state pension officials have become concerned that certain companies in their portfolios may be relying on peer groups that are flawed. “Peer-group comparisons assume that job responsibilities and job skills of the peer groups are similar and they may not be,” said Denise L. Nappier, the treasurer of Connecticut and fiduciary of the state’s $23 billion Retirement Plans and Trust Funds. “The thing about looking at C.E.O. pay of competitive companies, often companies will want a C.E.O. to be paid in the top quartile of his peers. But not everyone can be above average and this tends to ratchet pay up.”

Peer groups typically appear twice in proxies: first, in portions of the reports disclosing the annual comparison of total stockholder returns at a company versus its peers, and, second, in a section devoted to the calculation of executive pay. In the pay section, shareholders are sometimes told the peer-group percentile in which their top executives’ compensation falls. Typically, the filings state that corporate executives’ pay was in the 50th or 75th percentile of the benchmark group. If an executive is in the 50th percentile, he or she is in the middle of the pack; the 75th percentile means that only one-quarter of the group is paid more.

Compensation experts note that when a majority of companies in any given industry are in the 75th compensation percentile, pay packages may be subject to the Lake Wobegon effect: that all chief executives are suddenly above average. Corporate directors argue that comparing pay practices with those of competitors is only fitting, given that those are the companies they usually look to when recruiting employees and executives. But pay critics contend that an unquestioning reliance on the use of such peer groups is too simplistic and contributes to a one-size-fits-all mentality in pay.

“Sometimes it doesn’t matter what the other guy is doing,” said Brian Foley, an independent pay consultant in White Plains. “First and foremost is what makes sense for this company. If you’re in a turnaround and you are comparing yourself to guys who never had a dip and are quite successful, it’s a question not just of comparison based on size but also based on circumstances. I think these questions are asked sometimes, but sometimes they seem to be glossed over.”

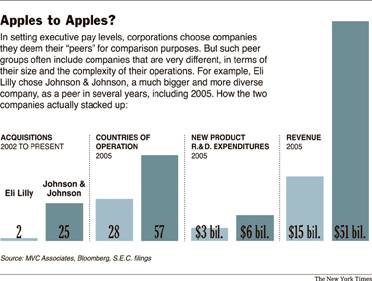

Ms. Nappier said her office was looking at how Eli Lilly used a peer group in its executive compensation practices. According to Lilly’s 2006 proxy statement, the company judges itself against a group of eight companies: Abbott Laboratories; Bristol-Myers Squibb; GlaxoSmithKline; Johnson & Johnson; Merck; Pfizer; Schering-Plough and Wyeth. Lilly’s stock underperformed the peer-group average in 2004 and 2005.

|

|

Comparing Eli Lilly with Johnson & Johnson, Ms. Nappier said, shows a stark difference, particularly when you look at the number of profit centers at J. & J. and the complexity of its business.

An official at Lilly did not return a phone call seeking comment.

Sometimes, compensation peer groups include companies that are not even in the same industry or are not of a similar size. An example is the peer group used by the Ford Motor Company, which described its selection this way in its 2006 proxy: “The consultant develops compensation data using a survey of several leading companies picked by the consultant and Ford. General Motors and DaimlerChrysler were included in the survey. Twenty leading companies in other industries also were included.” Ford, however, did not identify those companies.

Ford’s proxy also stated that the peer group it used in the compensation section of its filing was larger than the peer group it used in the stock performance portion of the same filing because “the job market for executives goes beyond the auto industry.” Ford said it chose the companies based on “size, reputation and business complexity” and said that over time, its goal was to peg its pay roughly at the median of the peer group, adjusted for company size and performance.

A Ford spokeswoman, Marcey Evans, declined to comment.

Mr. Reda, the compensation consultant, has a different perspective on how Ford uses peer groups. “That is just not appropriate,” he said. “A peer group should be based on size, profit margin — financial success, perhaps — but you can’t pick a company that has 15 percent profit margins when Ford is doing 8” percent.

Ford is by no means alone in extending its peer group well beyond its industry, Mr. Reda said. He noted that about 10 years ago, big brand-name companies began measuring themselves against other household-name companies, even though they were not in the same industry. Companies that made it onto Fortune magazine’s list of “most admired companies,” for instance, began to compare their pay to others on the roster.

Never mind that the connection was irrelevant, Mr. Reda said. “The result was a lot of pay got jacked up,” he said, “because companies in low-margin industries that didn’t do too well got pay hikes because they were in the ‘most admired’ candy store.”

EVEN companies that have won kudos for corporate governance can fall prey to peer-group traps. Consider the proxy filed last month by Campbell Soup, which provides continuing education programs for its directors. The filing, made after the S.E.C.’s 2007 proxy rules were issued but before they took effect, noted that its compensation committee compared total pay levels at 29 companies “in the food and consumer products industries with which Campbell competes for attraction and retention of talent.” Campbell’s compensation committee approved the companies in the peer group but did not identify them.

In computing Campbell’s total shareholder return, however, the company did not use the 29-company pay peer group as a benchmark. Instead, it used the Standard & Poor’s 500-stock index and the S.& P. 500 Packaged Foods Index, a subset of the S.& P. 500 that consists of only 11 companies, including Campbell. The company outperformed both benchmarks last year.

The use of dueling peer groups — one to measure stockholder return, another to calibrate executive pay — is common in corporate America. But Paul Hodgson, author of “Building Value Through Compensation,” questions the practice. “Best practice would dictate that, if a compensation committee report is to include a graph showing the company’s relative performance to peers, those peers should be the same as the group actually used to test performance,” he wrote in his book.

Anthony J. Sanzio, a Campbell Soup spokesman, said: “In terms of recruitment, we believe the landscape needs to be broader to attract and retain the best talent. For talent, we compete with a much broader group of companies that are much larger.” Mr. Sanzio declined to identify the 29 companies in the peer group but said Coca-Cola, Anheuser-Busch, Procter & Gamble and Johnson & Johnson were among them.

Mr. Van Clieaf, the compensation consultant, said the composition of peer groups is usually more heavily weighted to larger companies, even though corporations typically look to companies smaller than themselves when they are recruiting top executives. This reality calls into question the oft-heard argument that outsized pay is based on market forces and that because companies have to jockey for the very best, enormous compensation deals are reasonable.

“Where would you really go to look for talent,” Mr. Van Clieaf asked. “Either at the second or third layer down at bigger companies or the No. 1 role at smaller companies. Do you really think the C.E.O. of Johnson & Johnson is going to go to work at Eli Lilly?”

Even so, the pay handed out to executives at smaller companies — or to lower-level managers at larger concerns — are rarely included in peer groups, compensation experts and analysts say. Consider the pay awarded to the former Hewlett-Packard chief executive, Carleton S. Fiorina, which was based on a peer-group analysis. Although Hewlett hired Mark V. Hurd, the chief executive of the data processing giant NCR to succeed Ms. Fiorina as chief executive in 2005, Hewlett never included NCR in its peer group when calculating Ms. Fiorina’s compensation, according to Mr. Van Clieaf.

In fact, Mr. Van Clieaf said, Mr. Hurd’s pay while at NCR pay was 40 percent of Ms. Fiorina’s compensation at Hewlett. If Hewlett had included NCR in its peer group — thus adding Mr. Hurd’s lower compensation into the mix — Ms. Fiorina’s compensation would have wound up in a far higher percentile of the peer group than the median percentile that Hewlett reported, Mr. Van Clieaf said.

THIS year, Hewlett-Packard changed its peer group from a so-called blended one that included technology concerns as well as those from other industries, to a group that is limited to technology companies alone. They are I.B.M., Dell, Apple Computer, Cisco Systems, Electronic Data Systems, EMC, Intel, Lexmark International, Microsoft, Motorola, Oracle, Sun Microsystems and Xerox.

“This ensures that the cost structures that we create will enable us to remain competitive in our markets,” Hewlett’s 2006 filing said of its switch.

While Hewlett also noted in the filing that it believed that the design of its compensation plan was appropriate, it — like Campbell and Ford — used a different set of companies to compare its stock performance for shareholders. This shareholder peer group does not contain Intel, Oracle or Cisco. The company declined to comment further.

In the meantime, analysts say, compensation practices continue to be built on the same cheery performance assumptions found at Lake Wobegon.

“I think it is safe to say that in various situations the peer-group analysis has been soft,” said Mr. Foley, the compensation consultant. “And because it’s been soft, the determinations made about pay have been somewhat soft as well.”