How Big Tech Camouflaged Wall

Street’s Crisis

By Joe

Rennison Graphics by Eli Murray

March 31, 2023

The fate of the S&P 500 index — used by

investors as a barometer for the health of corporate America, and cited by

presidents as a measure of their handling of the economy — often comes down to

just two companies: Apple and Microsoft.

|

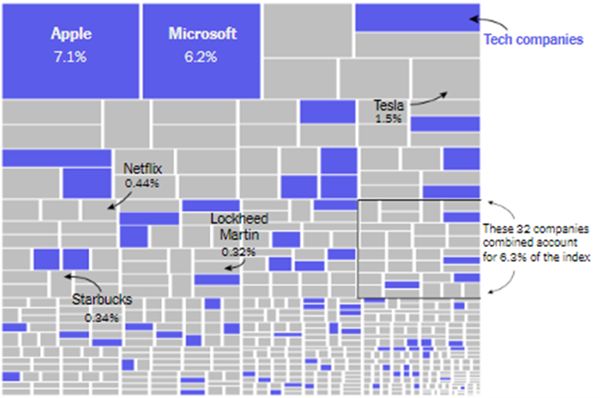

The companies

that make up the S&P 500, sized by share of market value.

Source: S&P Dow

Jones Indices • By Eli Murray |

This means it’s hard to invest in the U.S.

stock market, such as through a 401(k) or pension plan, and not be highly

dependent on the fate of the two tech giants. More than $15 trillion in assets,

from pension funds and endowments to insurance companies, are linked to the

performance of the S&P 500 index in some way, according to S&P Dow Jones

Indices, with more than 10 cents of every dollar allocated to the broad index

flowing through to Microsoft’s and Apple’s market valuation.

It is a phenomenon explained by how the

benchmark is constructed, and it is amplified by the way tech has come to dwarf

other industries, in the markets and the economy. And it means that the two

companies together can sway the direction of the broad market, sometimes masking

turmoil that has taken place underneath.

Trading in March offers a clear example.

Even after the failures of two regional banks in the United States and the

rescue of a global

investment bank in Europe sent a jolt through the financial system

and raised new fears about an already fragile global economy, the S&P 500 ended

the month up 3.5 percent.

Apple and Microsoft accounted for about

half of that gain, according to data from S&P. Both were seemingly immune to the

banking crisis and boosted by fervor over artificial intelligence, with Apple

rising 11.4 percent during the month and Microsoft 15.6 percent.

It can be jarring for investors to see the

index perform so differently from what they may have predicted, said Fiona

Cincotta, a stock market analyst at StoneX, a brokerage.

“It’s phenomenal that two companies can

direct so much power within the S&P 500,” she said. “These two companies seem to

have been single-handedly directing the index.”

It was true even at the height of the

frenzy. On Monday, March 13, immediately after the government seized Silicon

Valley Bank and Signature Bank, signs of panic were everywhere:

Several regional banks suffered their worst day ever in the stock market, with

First Republic Bank down more than 60 percent, in conditions so chaotic that

trading in many individual stocks was halted as stock exchanges tried to limit

the damage.

Outside the stock market, government

bond yields went haywire, oil prices slid and the dollar weakened,

all showing that alarms about the economy were ringing on trading desks around

the world.

Yet the S&P 500 spent much of the day in

positive territory, and it ended with a barely noticeable decline of 0.1

percent. Credit, again, goes to Microsoft and Apple, which both rose enough to

counter a 15 percent slide in the entire regional banking sector that day.

Much of this comes down to how the S&P 500

is designed. Its value is calculated by a measure that considers the overall

market capitalization of a company. It means the stock moves of the largest

companies carry the greatest weight, because even slight changes in their value

create or destroy billions of dollars of shareholder value.

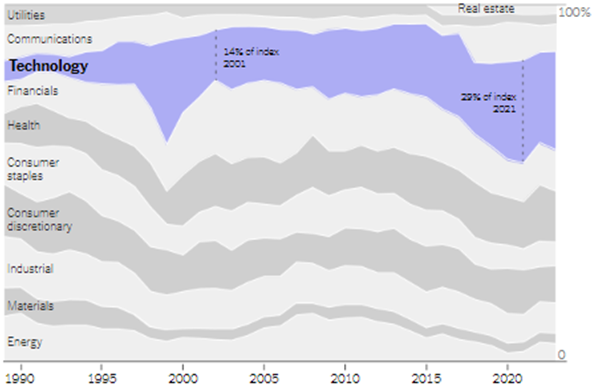

|

As one of 11

sectors that make up the S&P 500, the tech industry accounts for more

than a quarter of the stock index’s value.

Source: S&P Dow

Jones Indices • Categories are sized by market value. •

By Eli Murray |

Apple, at roughly $2.4 trillion, and

Microsoft, at $2.1 trillion, are so large that, taken together, the two

companies would be the third-largest sector of the index, behind tech and health

care. They would be larger than the energy sector and roughly the size of the

financials sector.

This influence is a result of a

decades-long shift in both the markets and the economy since the dot-com boom, a

change that accelerated after the 2008 financial crisis. Low interest rates put

in place to support the economy after the Great Recession made borrowing cheap

and pushed investors to seek out higher returns from riskier companies, spurring

financing and growth for tech companies. Apple and Microsoft excelled.

Apple in 2018 became the first American

company valued at more than $1 trillion on the stock market. As its value

inflated, so did that of its rivals Facebook (now Meta), Amazon, Netflix, and

Google (now Alphabet) — a group that came to be called the FANG

stocks. They helped to lift the index to new highs over a more than

decade-long bull

market. Since then, Apple and Microsoft have become proportionally

much larger, more than twice the size of the next largest company.

This dynamic is not wholly unusual in the

history of the S&P 500, though it is extreme, and it has been exacerbated by the

rapid growth of some tech companies through the pandemic. (At the end of 2018,

Microsoft’s and Apple’s combined index weight was less than Apple’s is today on

its own.) The previous company to reach Microsoft’s 6.2 percent weight in the

index was IBM in the mid-80s, based on data for the end of each calendar year.

“I don’t think it’s a problem,” said

Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. “This is what

the whole thing is worth, and if Apple or Microsoft go up or down, there is

proportional impact because they are worth more. It’s market-driven.”

The S&P also produces an “equal weight”

index, where each stock has the same effect on the wider group. In March, that

index fell 2.6 percent.

Another commonly cited measure of Wall

Street’s performance, the Dow Jones industrial average is a price-weighted index

that has been criticized for how it emphasizes companies based on their share

price alone.

And then there are the underlying sectors,

which are also tracked in separate indexes by S&P. These indexes, which tend to

more directly show pain afflicting their subsets of stocks, show that the

financial sector fell almost 10 percent in March, while energy stocks dropped

0.5 percent and real estate companies slid 2.1 percent. They also show that

other parts of the market — like utilities — fared just fine.

“There were so many sectors that

underperformed and were in the red across the month, and that was completely

pushed over and overshadowed by the gains in big tech,” Ms. Cincotta said.

S&P Dow Jones Indices, which maintains the

S&P 500 as well as the Dow, has tried to address the impact of these specific

weightings, at least on different sectors. In 2018, it moved Alphabet and Meta

out of the tech sector and into the communications category with Netflix, while

leaving Amazon in the consumer discretionary category with other retailers.

Since then, Meta, Amazon and Alphabet have

slowly lost value, while Apple and Microsoft have grown. The technology sector

in the S&P 500 has also been bolstered by the emergence of new behemoths like

the chip maker Nvidia, which is valued around three quarters of a trillion

dollars.

This month, S&P sought to rebalance the

index again, moving a handful of large tech-oriented companies — like Visa and

PayPal — into the financials sector, but further entrenching Apple and

Microsoft’s dominance as the two tech heavyweights.

Of course, this cuts both ways. In 2022,

the S&P 500 slumped close to 20 percent, a drop that would have been much

smaller without the lousy performance of the tech sector. Apple and Microsoft

together accounted for roughly one-fifth of the index’s total decline last year.

But for now, analysts see reasons for tech

to continue to rally.

One reason is the excitement over

artificial intelligence. Microsoft has a large stake in OpenAI,

the creator of ChatGPT, and many investors foresee the nascent technology

driving the next phase of growth for the companies developing the software as

well as the chip makers whose processors power it.

Tech stocks are also benefiting from the

concern over the country’s banks, which has led investors to quickly cut back

their expectation for interest rate increases from the Federal Reserve. The

sector is particularly sensitive to interest rates, and absent an imminent

recession, lower rates in the future would be a boost for the sector.

And, analysts said, large technology

companies have become havens where investors can wait out the current storm.

“It’s been a big bull cycle for tech,”

said George Catrambone, the head of Americas trading at DWS, a fund manager. “I

don’t think people will give up that paradigm easily.”

A correction was made on March

31, 2023: An earlier version of

this article misstated the impact Apple and Microsoft had on the S&P 500 in

2022. The two companies accounted for about one-fifth of the index’s losses last

year, not most of the losses.

When we learn of a mistake,

we acknowledge it with a correction. If you spot an error, please let us know

at nytnews@nytimes.com.

Learn

more

Joe Rennison covers financial

markets and trading, a beat that ranges from chronicling the vagaries of the

stock market to explaining the often-inscrutable trading decisions of Wall

Street insiders.

A version of this article appears in print on April

1, 2023,

Section B, Page 1 of the New York edition with the headline: How Big Tech

Camouflaged Wall Street’s Crisis.

© 2023 The

New York Times Company