|

Investor Choice

Investors report strong interest in proxy voting choice

April 24, 2025

A recent Vanguard survey of more than 1,000 investors shows a strong

interest among investors in having a voice in the proxy voting

process.

Asset managers have begun offering proxy voting choice programs that

enable investors to help direct how their equity index funds vote at

company shareholder meetings. The survey delved into investors’

perspectives on these programs, and its results provided key insights

about investors’ interest in participating, along with the topics they

consider important to weigh in on and their general awareness of proxy

voting.1

Key findings from the survey include:

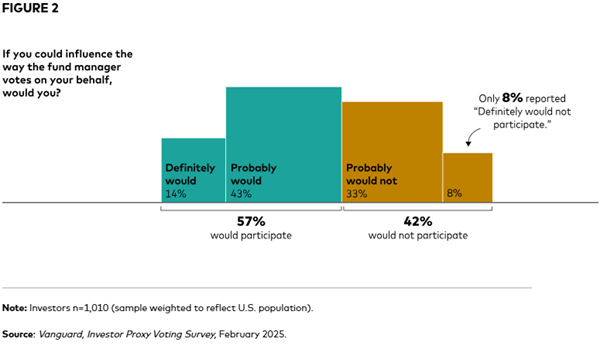

Investors want a voice.

According to the survey, most investors agree that it’s important that

asset managers consider investor preferences when casting votes for

their equity funds.2 More

than half (57%) of those surveyed would participate in a program to

influence fund managers’ votes, and even more (66%) would participate

in a program offered through their retirement plan to do the same.

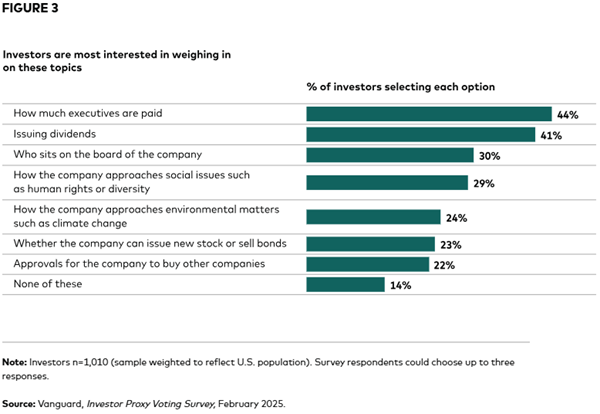

The survey results also highlighted governance topics that are most

important to investors. Respondents selected executive pay (44%),

issuing dividends (41%), and who sits on the board of the company

(30%) as the three most important topics they would want to weigh in

on through the proxy voting process.

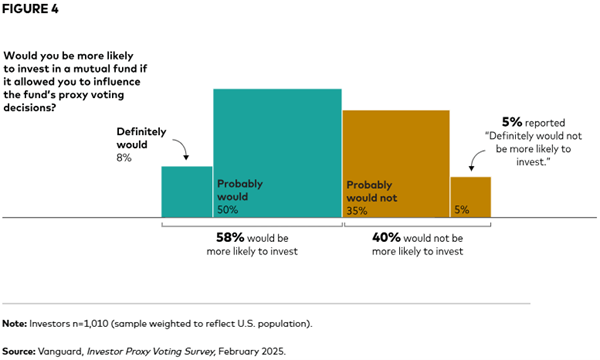

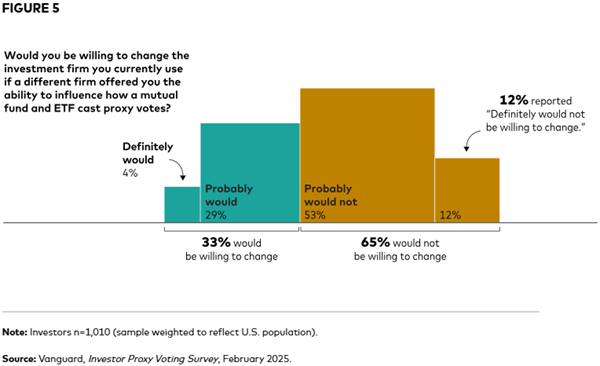

Voting choice can influence product and firm selection.

More than half the investors surveyed said they would be more likely

to invest in a fund if they could influence the fund’s proxy voting

decisions. One in three reported being willing to change firms if

another firm offered them the ability to influence proxy voting.

Investors under age 45 were more likely than those 45 or older to say

they would be willing to change firms.

Results show an opportunity to increase investor

understanding.

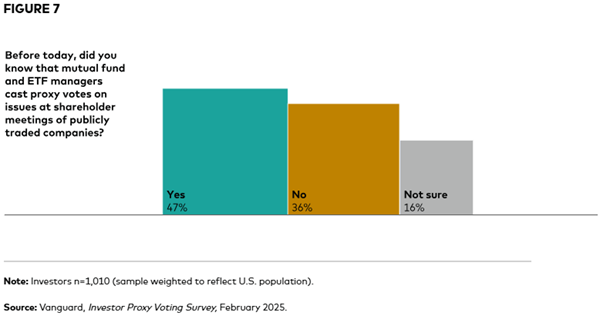

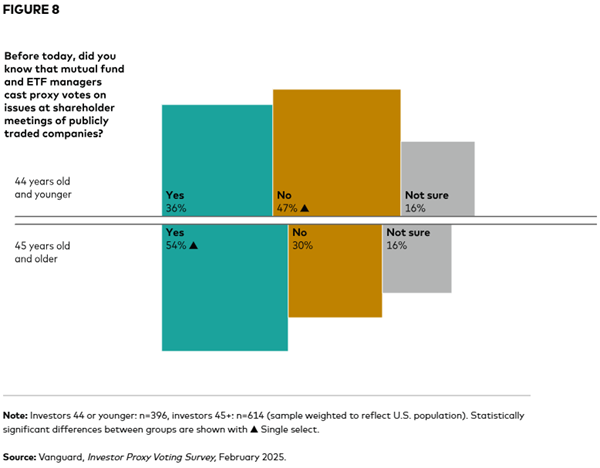

Nearly half the investors surveyed were already aware that fund

managers cast proxy votes at shareholder meetings on behalf of their

investment funds. Only 36% of younger investors (44 or younger)

reported being familiar with proxy voting.

Vanguard Investor Choice provides a channel to bring more

voices to the table.

The Investor Choice pilot program enables millions of individual

investors, their advisors, and retirement plan sponsors to make their

voices heard on important shareholder matters at portfolio companies

held in participating Vanguard funds. Through Investor Choice,

investors can make a single policy selection from a range of proxy

voting policy options that determine how their proportionate fund

ownership is voted at shareholder meetings. Vanguard investors who

hold an equity index fund directly with Vanguard can make a proxy

voting policy selection here.

1

Ipsos

conducted the study February 28–March 2, 2025, using its large-scale,

nationwide online research panel, KnowledgePanel, among a weighted

national sample of 1,347 adults 18 or older living in all 50 states

and the District of Columbia. Among that sample,1,010 self-identified

as investors. The margin of sampling error for the full sample is ±2.9

percentage points, including a design effect of 1.16.The data for the

total sample were weighted to adjust for gender by age,

race/ethnicity, and education, census region, metropolitan status, and

household income using demographic benchmarks from the 2024 March

Supplement of the Current Population Survey. Benchmarks for the

investor’s subgroup were obtained by using the weighted percent of the

general population. Investors were defined as respondents who

indicated in the survey that they have any of the following types of

accounts/funds: retirement funds (e.g., 401k, IRA, Roth IRA), a

high-yield savings account, a certificate of deposit (CD) account, a

money market account, a brokerage account (e.g., where you choose

which stocks, bonds, and mutual funds you invest in), or a managed

investment account for which a financial advisor manages and chooses

investments for you.

2

Percentages in the charts may not total 100%, as respondents were not

required to answer every question.

© 1995–2025

The Vanguard Group, Inc.

|