The New York Times Company: 2020 Investor Interests

Importance of elements that differentiate NYT publishing model

Interest in specific publishing products

Comments offered for NYT management and for other shareholders

Shareholders of The New York Times Company (“NYT”) were invited to report

their views of investor interests, anonymously, during the period from

August 17 to September 21, 2020.[1]

The

survey research was initiated by a NYT shareholder, guided by professional

investment and publishing industry advisers, to determine broader investor

market levels of analytical interest in particular elements of an apparently

successful business model. The

survey questionnaire requested an indication of the participating

shareholder’s investment horizon and then rankings of the importance of an

investor’s understanding various elements of the NYT publishing model.

Following those questions, participants were asked to volunteer information

that might be useful in analyzing anonymous responses, and were also offered

opportunities to present questions or comments for consideration by NYT’s

management or by other shareholders and analysts.[2]

Responses, details of which are reported below, provided two significant

indications of investor market support for NYT’s news publishing model and

related management strategies.

►

Participants reported higher levels of importance to understanding elements

of performance that distinguish NYT from alternative news publishing models,

as might be expected in shareholder views of a company they have selected

for investment. These were the most highly ranked, with very similar levels

of interest among all segments of shareholders.

(1)

Strategies for existing and new directly produced product

(2)

Size of subscribing audiences

(3)

Strategies and targets for subscription growth

► Most

notably, approximately three quarters of the participants, including a

majority of those owning 5,000 or more shares, reported investment horizons

of more than 5 years.

Importance of elements that differentiate NYT publishing

model

The

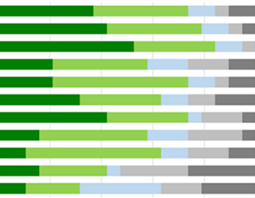

graph below shows participants’ rankings of their interest in understanding

each of the stated elements, listed here in the order of total responses

reporting “essential,” “important,” and “useful.”

|

Segment

Analysis

5,000 or more shares owned

|

|

Response patterns did not differ meaningfully in rankings of importance

between participants reporting larger and smaller numbers of shares owned,

but larger shareholders evidenced somewhat higher levels of interest in

“Strategies and targets for subscription growth.”

The

graph image on the right shows the response levels for this key investor

segment, with each element presented in the same sequential order as the

graph above for purposes of comparison.

Interest in specific publishing products

Shareholders who considered levels of particular reader interest relevant to

investment analyses were asked how important it was for them to understand

NYT’s progress with specific types of publishing products, as well as the

importance of competitive quality for various publishing subjects. Responses

to both are shown in the following graphs, again with each subject

presented

in the

order of total responses reporting “essential,” “important” and “useful.”

Several participants offered views relating to “other” publishing products,

including suggested attention to science and technology, and to editorials

relating to political and social issues. Many of the comments offered in

response to an invitation of “other observations” addressed participants’

interests as readers, as might be expected from shareholders who were also

subscribers, but also included these examples focused on investment

interests (all comments are available for review in an exhibit referenced

below):

-

Our

shares have gone up because NYT is making smart decisions on how to

capture audience in many different ways and overall coverage of Trump's

shenanigans is essential.

[individual investor, over 5,000 shares]

-

Understanding actual and expected conversion of intro subs into full

paying subs by cohort, especially during the recent period of accelerated

intro subscribers, is essential to my investment analysis of the NYT.

Thank you for putting this questionnaire together!

[professional fund manager, over 5,000 shares]

-

How

about in-depth investigative reporting e.g. in the Sunday Magazine?

[individual investor, less than 5,000 shares]

Comments offered for NYT management and for other

shareholders

Participating shareholders were invited to present comments and questions

for NYT management, as well as suggestions of subjects for future company

reports or conference call presentations, with the assurance that their

responses would be presented to the company with sources identified only as

anonymous participants in the survey. Participants were also invited to

offer questions and comments for consideration by other shareholders, with

similar provisions for anonymity.

The

following examples of comments provide an indication of the interests

addressing investment issues.

Questions or comments for management consideration:

-

You

guys are the experts, and I'm sure the you have considered it, but I would

imagine that there is enormous potential to leverage your national and

international reporting across many new paid digital subscribers by

offering local content specific to many locales. Local papers are really

dying. You could replace many of them and throw in excellent

national/international coverage. Plenty of local reporters out there

looking for a job. But, as hard as it seems, you may have to consider a

name change for a product like this!

[individual investor, over 5,000 shares]

-

What

is the new CEOs strategy.

[individual investor, less than 5,000 shares]

-

How

do you view The NYT's partnership with ProPublica?

[individual investor, less than 5,000 shares]

-

What

plans do you have for advancing the ethics in today's journalism? How do

you plan to attract talented young people to journalism?

[professional fund manager, less than 5,000 shares]

For

management to address in a future conference call or report:

-

More granular view on pricing cohorts and overall financial impact of

price increases. Margin expansion: a significant portion of the cost

structure is somewhat fixed, it would be great for management to put some

hard stakes in the ground regarding margin expansion objectives. The

company is now very capital efficient and cash generative, it is more than

time that it presents to shareholders a coherent and value maximizing

capital allocation strategy.

[professional fund manager, over 5,000 shares]

-

[A] greater understanding of the revenue potential and profit opportunity

of digital, video, and podcasts.

[individual investor, more than 5,000 shares]

-

How NYT might be thinking about filling the void left by local reporting

in other markets (i.e., California edition).

[individual investor, more than 5,000 shares]

For

reporting to other shareholders:

All

comments, including the many observations focused on subscriber interests

which are clearly relevant at least indirectly to investor interests, are

presented in the following report with editing only to eliminate identifying

information:

2020 NYT Shareholder Survey: Participant

Comments

ttt

NYT

management has asked the Forum to report their gratitude to the shareholders

who offered their views, and the company’s Vice President of Investor

Relations has provided the following statement: “The New York Times Company

appreciates input from our shareholders and we will consider incorporating

this feedback in future communications.”

This

summary is being distributed to all shareholders who participated in the

survey and requested a report of its results, with thanks for their

contributions of views to benefit other shareholders and NYT’s management.

Questions and comments about the survey results will be welcomed, and can be

addressed to

nyt2020@shareholderforum.com.

GL

– September 30, 2020

Gary

Lutin

Chairman, The Shareholder Forum

©The Shareholder Forum, Inc.