|

CORNER

OFFICE

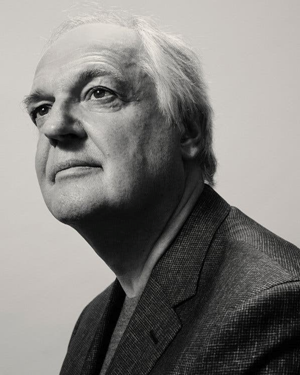

He Ran an Empire of Soap and Mayonnaise. Now He

Wants to Reinvent Capitalism.

As chief executive of Unilever,

Paul Polman tapped into the company’s history in an effort to make

it more sustainable, and profitable.

|

Erik Tanner for The New York Times |

Published Aug. 29, 2019

Updated Aug. 30, 2019

When nearly 200 top chief executives recently came out

with a

new mission statement proclaiming that corporations should

serve more than the bottom line, they may as well have been channeling

Paul Polman.

Mr. Polman is the recently

retired chief executive of Unilever, which makes everything

from Dove soap to Hellmann’s mayonnaise. As C.E.O. of the Anglo-Dutch

consumer goods company for nearly a decade, he turned around

Unilever’s fortunes while developing a reputation as an enlightened

corporate leader.

Mr. Polman developed an

ambitious plan to double Unilever’s revenues while cutting the

company’s negative effects on the environment in half. He helped rally business

leaders to support the Paris climate accord in 2016. And in 2017 he fended

off a takeover attempt from Kraft Heinz, another big food company

with a corporate culture that couldn’t have been more different from Unilever’s.

After stepping down last year, Mr. Polman started Imagine, a

consulting firm focused on environmental and social responsibility. This

interview, which was condensed and edited for clarity, was conducted in New York

City.

What

was your childhood like?

I grew up in the Netherlands in the years after World War II. My

parents were just married and had suffered through the war. As a result, they

weren’t able to go to university. My father worked himself up to be an

administrator in a tire factory. My mother was a schoolteacher. Their sole goal

was to be sure that we would get our education and go to university and have a

better life than what they had to endure.

When we

spoke a few years ago, you told me you studied to become a priest.

I went to Catholic school and ended up being an altar boy. I

liked it because when there were weddings or funerals during the week, it got

you out of school. If you were lucky, you could drink a little bit of wine if

nobody was looking. I started thinking I wanted to be a priest. Helping others

and being in that position must have been appealing to me. I went to the

seminary, but unfortunately there were not enough people enrolled, and they

closed up and moved it to a different city.

What

was your first job?

I was a maintenance man at night and during the weekends in an

office tower in Cincinnati while I was doing a double degree, M.A. and M.B.A.,

at the University of Cincinnati. When I graduated, I sent out a lot of résumés

to many different companies around there, and Procter & Gamble called me in for

an interview. They said, “We need someone in finance in Belgium.” So I ended up

in a factory in Belgium as cost analyst.

You

were at P.&G. for quite a while, and then at Nestlé. What were your big

takeaways from those jobs?

P&G started in 1837, and it’s still going strong, at a time when

the average lifetime of a publicly traded company is only 17 years. The company

has enormous values that permeate all levels and all places in the world that it

operates. Ethics, doing the right thing for the long term, taking care of your

community is really the way you want a responsible business to be run. A search

for excellence would also apply to P.&G. You always wanted to ensure that you

had the best products.

At Nestlé I found a totally different way of doing things. P.&G.

was a little bit insular because the results until then were fairly good,

so you also think you’re invincible to some extent. Nestlé is a

very modest Swiss company, and thinks quite differently. It’s far more

decentralized because the food business means working a lot with farmers and

investing in these countries. It had a big footprint in these emerging markets,

and a business model that is flexible. Food, by nature, is a little bit more

local.

And how

did you wind up as C.E.O. of Unilever?

I ended up at Nestlé as the chief financial officer, and then

Unilever was looking for a new C.E.O. They interviewed quite a lot of people,

but at the end they chose me. I insisted they check that there were no better

people out there, because I knew there were. Once you get the challenge under

your skin, you want to go for it. It’s an Anglo-Dutch company, and being Dutch

myself, that’s how I became the C.E.O. 10 years ago.

When you go from one company to another, you learn a little bit

of modesty, you learn listening skills. I could not have gone from P.&G. to

Unilever. But having three years at Nestlé prepared me for the job at Unilever.

Pretty

soon after you started at Unilever, you launched an ambitious sustainability

agenda. To what extent was that mind-set being developed during your time at

P.&G. and Nestlé?

At P.&G., I moved to Newcastle and was responsible for the U.K.

and Ireland. In Newcastle, many people had lost their jobs, and for the first

time I saw second-generation unemployment. We were the biggest employer, so I

got involved in efforts to help make that community grow. This was a defining

moment. I began to orient a little bit less just toward myself and my career,

and got a little bit broader perspective of humanity and what are the more

important things in life.

Going to Nestlé, it added another dimension because Nestlé is

incredibly strong in these on-the-ground programs, investing in these emerging

markets and helping build up economies over 10, 20, 30 years’ time. Those two learnings were

the most important ones I took with me going to Unilever.

Where was Unilever as a company when you arrived in January 2009?

It was at the height of the financial crisis. At Unilever, we

unfortunately had had 10 years of decline. The company had gone from $55 billion

to $38 billion in turnover. It had become a little bit too short-term focused.

But we had good brands, good people. Coming in from the outside wasn’t easy.

Some people said, “Why is that needed?”

I thought if we want to change the company, we would need to do

something that Jim Collins talks about in his book “From Good to Great,” which

is nurturing the core before you stimulate progress. I had to find that core, so

for one of the first meetings with my management team I brought them to the

British village of Port Sunlight, to the former home of Lord Lever, who founded

the company.

He built Port Sunlight before the factories were fully running to

provide houses for his employees. He had the highest number of volunteers in

World War I because he guaranteed the wages and the jobs and he helped the wives

when the men were gone. No smoking and no drinking in Port Sunlight made the

life expectancy better. He fought for six-day work weeks. He introduced pensions

in the U.K. He brought these values to the company, and he believed in shared

prosperity.

What

did doing that accomplish?

Going back to our roots gave me the permission to drive change.

People would say, “Yeah, he’s bringing back values that were at the roots of the

success of this company.” We were there and saying we needed to have a more

responsible business model. We came up with a very bold objective to decouple

our growth from our environmental impact.

One of

the first things you did was stop issuing short-term guidance. Why was that

important?

If you want to make the company grow longer term, you have to get

out of this rat race of quarterly reporting and quarterly behavior. Many

companies manipulate their behaviors, their spending, to avoid missing

expectations. Jack Welch, in his book “Straight From the Gut,” talks about

hitting quarterly expectationsover and over and missing it only twice by one

penny, how wonderful that was. But he obviously used G.E. Financial to

manipulate that. If he was that wonderful, he should have been in Las Vegas.

We were doing the same thing. We were more occupied by the

quarters and would hold spending back and start it again a month later, or do

other things that weren’t in the best interest of the company. I wanted to get

out of that. We needed to provide the environment for people to be successful.

You cannot solve issues like poverty or climate change or food security with the

myopic focus on quarterly reporting.

Not

many companies have followed your lead. What will it take for more companies to

start acting more responsibly?

If it was that easy, it would have been done. It’s hard work. The

road to change has a lot of skeptics and cynics.

We need to reinvent capitalism, to move financial markets to the

longer term. C.E.O.s are basically good people. There are no C.E.O.s who want

more unemployment, or more people going to bed hungry, or more air pollution.

But then why collectively do we behave so miserably? It’s because we spend too

much time on dealing with the impacts and not with the underlying causes.

We have to move the financial markets to the long term as systems

change. We need to decarbonize this global economy if we want to keep it

livable. We need to find an economic system that is more inclusive.

Why did

you turn down the bid from Kraft Heinz?

It was a purely financial transaction that was attractive on

paper, but was really two conflicting economic systems. Unilever is a company

that works for the long term and focuses on the billions of people that we

serve. Kraft Heinz is clearly focused on a few billionaires that do extremely

well, but the company is on the bottom of the human rights indexes or on the

efforts to get out of deforestation. Kraft Heinz is built on the concept of

cutting cost.

Since then, their share price is down 70 percent, and they now

face legal issues around reporting. Our share price is up about 50 percent. Some

people think greed is good. But over and over it’s proven that ultimately

generosity is better.

David

Gelles is the Corner

Office columnist and a business reporter.

A version of this article appears in print on Sept. 1, 2019,

Section BU, Page 4 of the New York edition with the headline: To Drive Change,

Look Past the Bottom Line.

© 2019 The

New York Times Company